Introduction to 7Steps &

Expertise in Insurance AI Solutions

Since our founding in 2013, 7Steps has grown into a trusted Canadian partner for AI-driven solutions tailored to the insurance industry. With a dedicated team of 70-80 full-time, locally based experts, we focus on enabling efficiency and precision for insurers, brokers, and policyholders alike. Our platforms, including Brain of Intake and Brain of Claim, are crafted to solve specific challenges, streamline operations, and enhance decision-making for Canadian insurers, brokers, and other stakeholders.

Key Solutions for

Streamlined Operations &

Enhanced Decision-Making

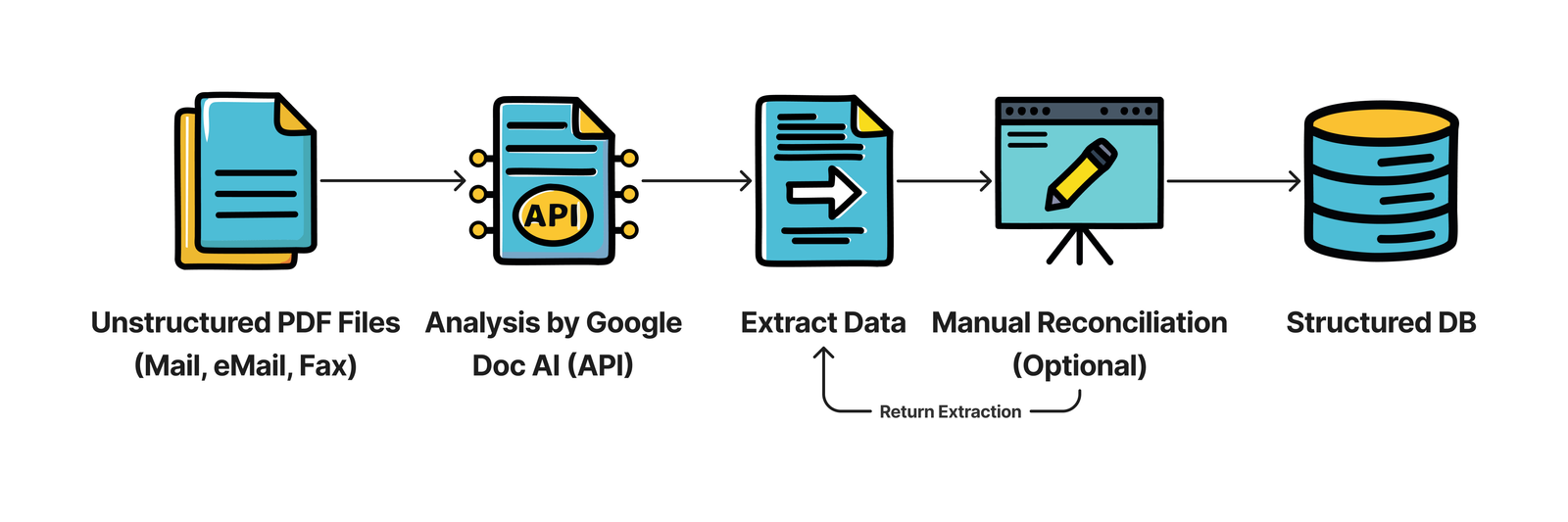

Brain of Intake (BoI): AI-Driven Document Intake System

The Brain of Intake is a transformative document intake tool that digitizes, categorizes, and routes hard-copy or non-writable files like PDFs, making them actionable in real-time. Using OCR capabilities, BoI scans and parses data from various document types, automating claims data organization and identifying potential fraudulent submissions. This process reduces human error, enhances data intake, and optimizes risk management, allowing examiners to process claims faster and more accurately. Hive directly supports compliance by ensuring data accuracy and audit readiness.

BoI Main Process

Documentation

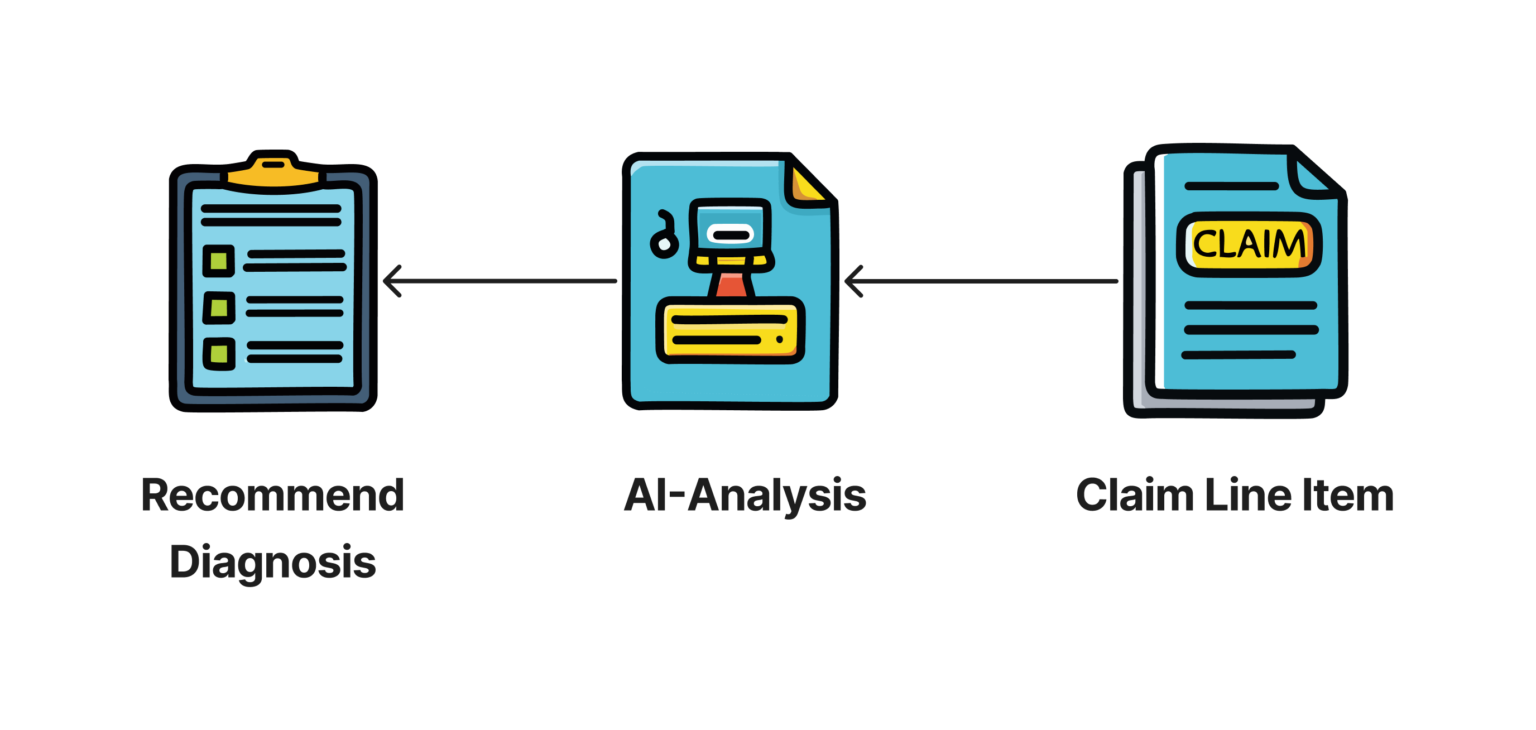

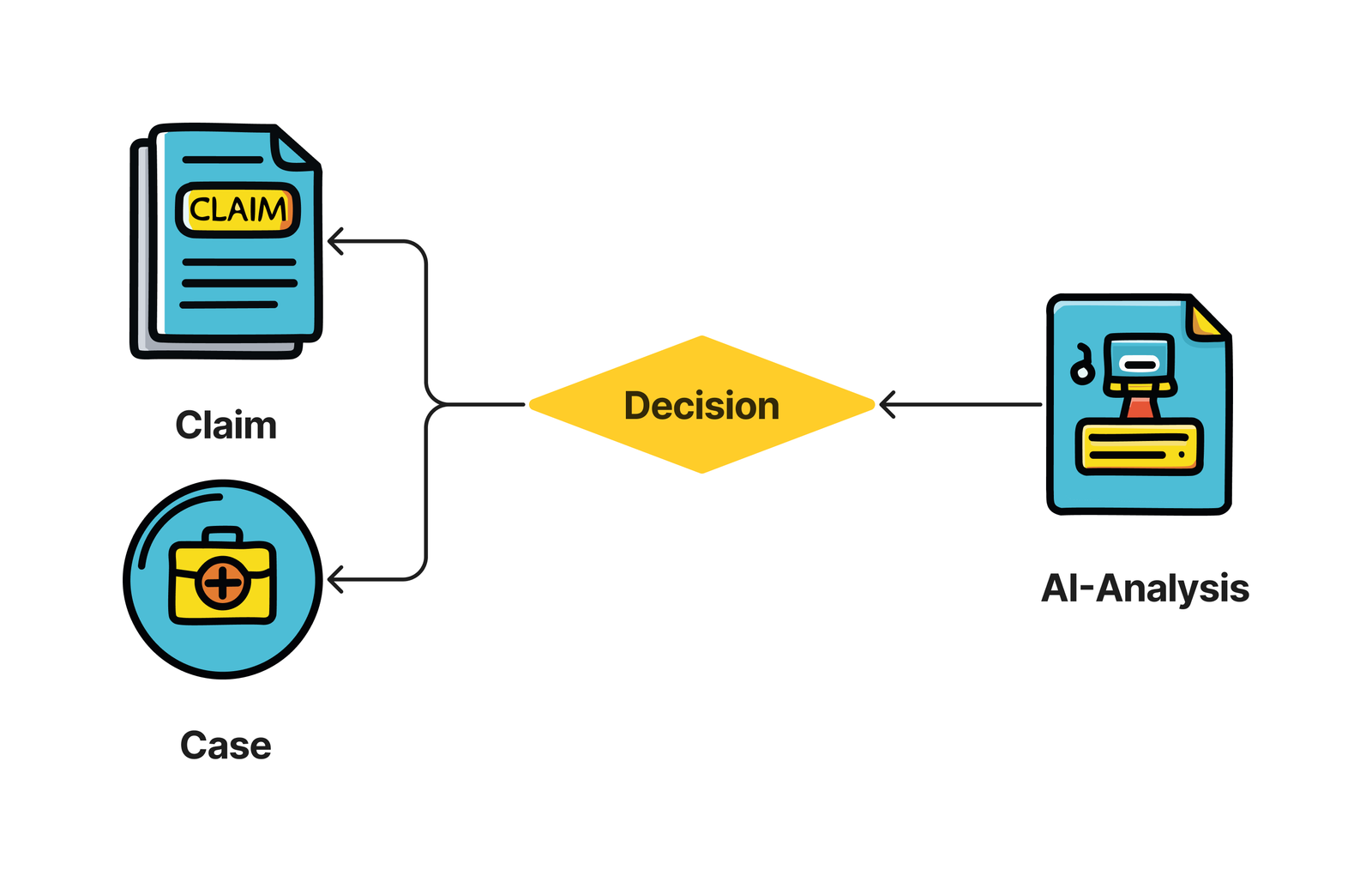

Identify Claim Case

Brain of Claim Examiner (BoCE): Intelligent Claims Processing & Provider Onboarding

BoCE redefines claims processing and provider onboarding with multi-functional AI capabilities

Grammar & Content Enhancement

Template Recommendations

Duplicate & Fraud Detection

Case Grouping & Auto-Assignment

By automating the claims lifecycle and provider onboarding, Brain of Claim Examiner not only speeds up processing but reduces administrative costs and helps insurers prevent fraud—saving the industry billions annually.

Advanced Integration Capabilities for Expanded Data Access

Advanced Integration Capabilities for Expanded Data Access

With over 20 existing integrations—including systems like Nice, ERB, and major payment gateways—7Steps’ platform allows for seamless data flow across multiple sources. This ensures insurers can maximize reporting, customizations, and data analysis across claims processing, provider management, and client interaction channels. As the insurance landscape evolves, the platform is designed to integrate additional data sources, supporting long-term adaptability.

Market Impact and Results for Insurance Providers

Market Impact and Results for Insurance Providers

Implementing 7Steps’ AI-driven platform yields measurable improvements in efficiency, customer experience, and risk management for insurers:

Faster claims processing

By automating workflows and consolidating claims, our platform speeds up claims handling, resulting in quicker responses and higher client satisfaction.

Fraud reduction

Advanced fraud detection capabilities in Horus identify patterns in claims data, cross-reference with historical records, and flag suspicious claims, helping insurers reduce

Operational cost savings

Automation of labor-intensive processes within claims and provider management workflows leads to significant reductions in administrative costs.

Higher client retention

Enhanced, AI-driven customer service builds trust and loyalty, helping insurers maintain a competitive edge.

Market-Driven Insights on Insurance Needs

& 7Steps’ Solutions

Growing Demand for Digital Transformation

Improved Regulatory Compliance and Data Accuracy

AI as a Competitive Differentiator

Through these strategic enhancements, 7Steps' platform addresses current market demands, setting insurers on a path to achieve operational efficiency, regulatory compliance, and superior customer service—essential pillars of sustained growth and competitiveness in the modern insurance landscape.

Collaborative Action Items & Next Steps

Our team is committed to supporting insurance companies with demos tailored to specific needs in claims and document analysis. Through targeted demonstrations and follow-up discussions, we’ll explore how our AI platform can meet your business needs. Our goal is to help you build an efficient, future-ready insurance system that enhances decision-making and streamlines operations, positioning your company to lead in a competitive market.