GuardMe, a leading insurance company, faced significant challenges in processing

Offline channels claims efficiently. The traditional method of handling papers claims involved manual sorting, scanning, and data entry, leading to delays and errors. In response to these challenges, GuardMe embarked on a transformative journey to develop a configurable standalone software solution “Hive.” This case study delves into GuardMe’s innovative approach to streamlining claims processing using advanced technologies like Google Doc AI.

The Challenge

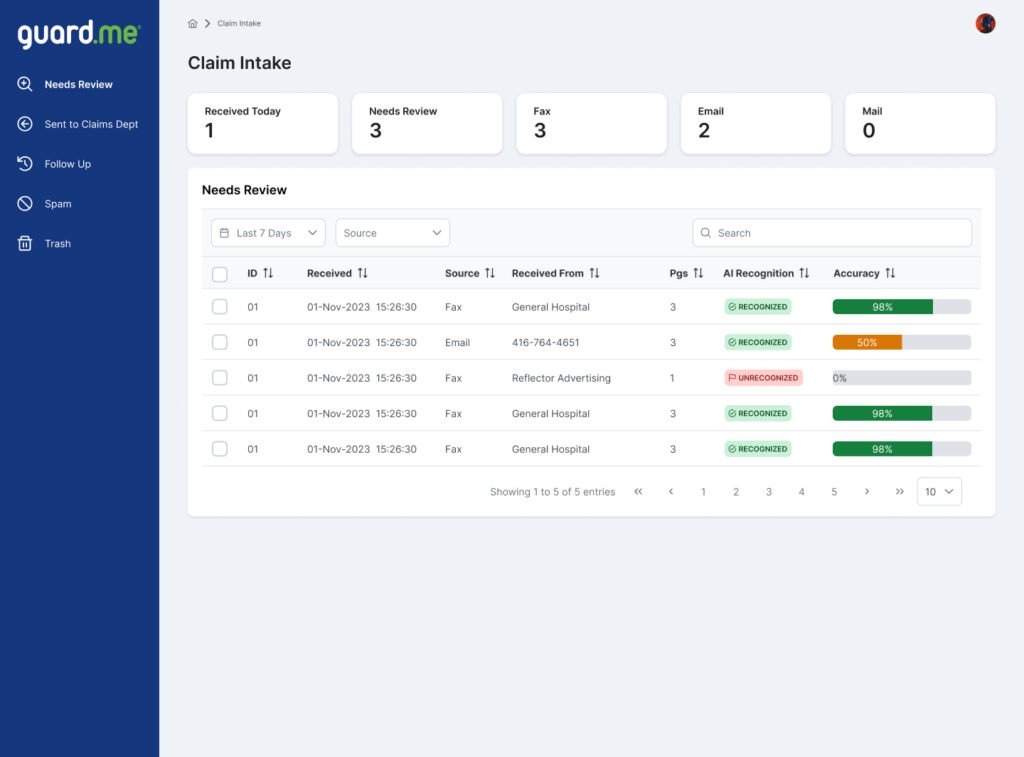

- Incoming claims arrived via multiple channels including fax, mail, and emails, necessitating manual sorting and handling by staff.

- Each claim required meticulous reordering, scanning, and data entry to ensure it was processed accurately, leading to significant time and resource consumption.

- The manual nature of these processes made it difficult to scale operations to meet increasing claim volumes, resulting in bottlenecks and delays.

- The manual steps involved in claims processing, such as sorting, scanning, and data entry, were time-consuming and prone to human error.

- Staff spent considerable hours each day sorting through incoming claims, identifying missing information, and manually inputting data into the system.

- These time-intensive processes hindered Guard Me’s ability to process claims promptly, leading to dissatisfaction among customers and providers.

Variety of Invoices

- Guard Me encountered various types of invoices, each with its own format and structure, making it challenging to standardize the data extraction process, along with the manual work to handle them.

Data Accuracy

- Manual data entry led to errors and inconsistencies in claims processing.

SPAM Handling

- Sorting through SPAM emails and other irrelevant communications added an additional layer of complexity to the claims processing workflow.

Communications with Other Teams

- Coordinating communication between departments regarding missing documents or complicated claims.

- Updating new providers contacts information or providers with invoices came from new Fax numbers or emails.

The Solution

Guard.me partnered with leading technology experts (247 Labs team) to develop Jarvis Application; a comprehensive insurance management solution tailored to the needs of educational institutions for EU clients.

Key features of Jarvis Application include:

- Enrolment of Policies: Simplified enrolment process for Schools, with options for manual upload or AI-based smart tool to auto-fix upload errors.

- Policy Management: Intuitive dashboard for managing policies, including actions such as extending coverage, editing policy dates, and cancelling coverage.

- Admin Portal: Centralized platform for administrators to manage insurance plans, client campuses, service agreements, reporting (Power BI Integration), invoices (QuickBooks Integration), user management, and communication.

- Schools Portal: Dedicated portal for schools to enrol policies, process payments (Opayo/Barclays cards/PayPal), manage invoices, access documents, and manage users.

- Students Portal: User-friendly interface for students to view policy details, access policy documents, and manage their accounts.

The Birth of Hive

Key Features of Hive Application

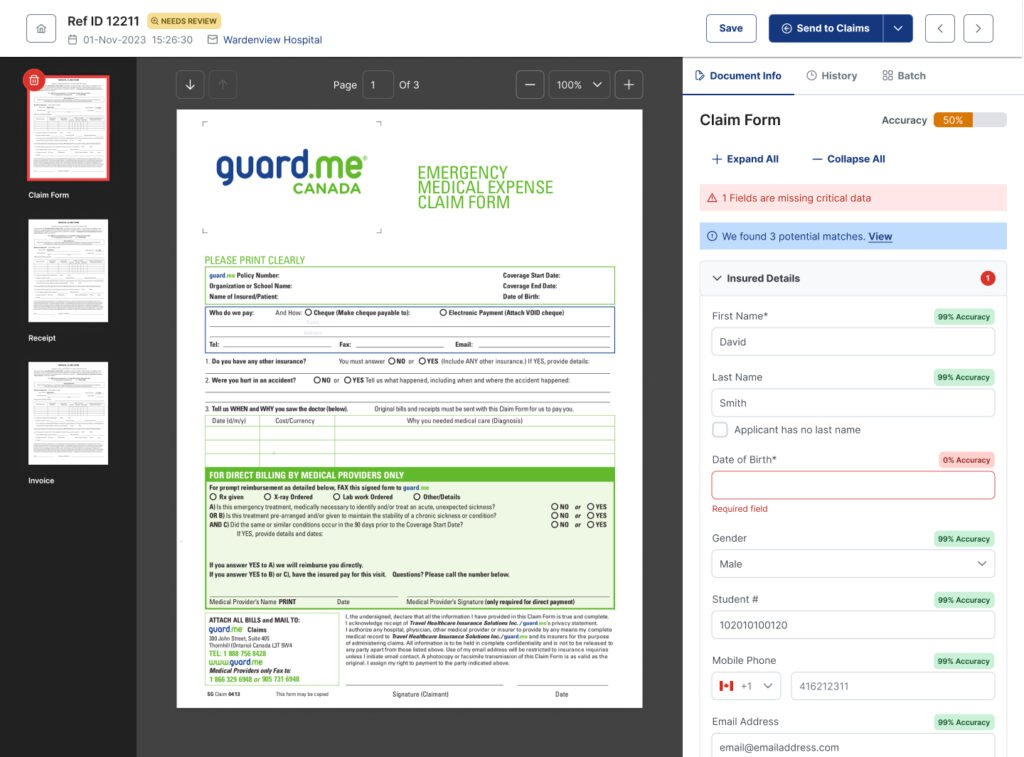

- Document Parsing with Google Doc AI: Hive leveraged Google Doc AI training models to extract fields and data from PDF files, emails, and other documents automatically, including various types of invoices and claim forms.

- Enhanced Data Accuracy: Hive advanced data validation techniques made to ensure accuracy even when multiple documents provided different values for the same user data. It reconciled conflicting data sources and flagged inconsistencies for user review, minimizing errors and discrepancies.

- Document Configurability: Hive was designed to be highly configurable, allowing users to move and reorder pages between batches in case any other human interfere is needed to organize claim and invoice.

- Document and Field Review: Users can review extracted documents and fields before sending claims to the claim department. They could verify the accuracy of data and make any necessary corrections or annotations, by help of Hive data validation and notification system.

- Provider Updates: Hive allowed users to easily update provider contact details. Changes were automatically propagated across future claims and invoices, eliminating manual updates and reducing the risk of outdated information.

- SPAM Filtering: Advanced algorithms within Hive helped identify and filter out and flag spam records and unrecognized documents, reducing the manual effort required to sift through irrelevant communication. Users could use spam folders to adapt to evolving spam patterns and ensure high accuracy.

- Interdepartmental Communication: Hive facilitated seamless communication between users, allowing claims handlers to collaborate effectively and resolve issues efficiently.

The Results

-

<span data-metadata=""><span data-buffer="">Efficiency Gains: Hive significantly reduced processing time,

enabling GuardMe to handle higher volumes of daily tasks efficiently. - Improved Accuracy: Automation reduced errors and discrepancies, enhancing data accuracy and reliability.

- Faster Turnaround: Hive expedited claims processing, invoice handling, and communication, improving overall operational efficiency and users and customer satisfaction.

- Cost Savings: By reducing manual labor and streamlining processes, GuardMe achieved substantial cost savings. The automation of repetitive tasks and the elimination of manual data entry reduced labor costs while also minimizing errors, leading to significant savings in operational expenses.